Market Review: Bond holder rout

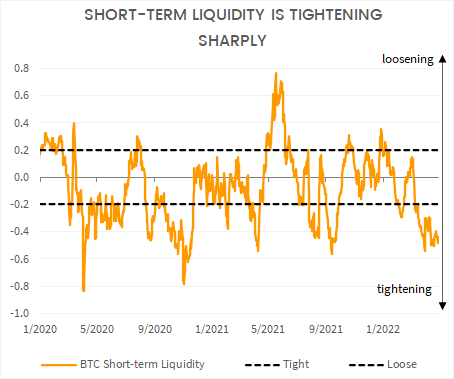

Fissures in the foundation of the global financial system appeared in April as government bonds - the centre of our brittle financial system - experienced the weakest month on record. Volatile weakness in the world’s primary collateral asset further highlights the monetary regime change underway and the important role alternatives like bitcoin may have to play in that process. Shorter-term, rising Treasury yields will likely send the US economy into a recession, pressure the US dollar higher and tighten global liquidity, which is the biggest risk to bitcoin over the coming months.

Return summary

Weaker month for BTC. 15.3% decline following reasonably strong February (+14.3%) and March (+4.3%).

ETH weakened 13.7% in April, while the S&P500 was down 5.4% and gold declined 2.4%. The crypto : equity market correlation remains strong and trad-fi macro conditions are the major driver.

Barclays Aggregate weakened 4% in April and has now lost 10% over the past year. The US bond market recorded its weakest start to a year on record.

Breakouts underway on USDJPY and USDCNY as the dollar surges in response to higher US rates - accentuating trad-fi liquidity risks.

The Fed is sticking to its tightening course, for now. The deeper the liquidity pain, the sooner and sharper the reversal.

Long-term holders looking through short-term volatility and buying bitcoin below $40K

Extreme weakness in the assets that sit at the centre of the financial system - bonds - has numerous ramifications on the global economy, financial markets and bitcoin

Institutional trad-fi pressures point towards eventual crypto allocation

Traditional institutions like banks, insurers and certain pension funds may come under severe pressure in the face of weaker bond markets. Some of these institutions are mandated to hold government bonds and others are working with models which bias them towards long-term bond holdings.

One of the key conclusions of modern portfolio theory is for investors to hold bonds as a hedge against equity weakness because bonds and equities tended to be uncorrelated over the last 50 years. But the low or negative correlation may not hold going forward because they are no longer pristine collateral, governments are hugely indebted and monetary inflation is almost of guarantee for the next 5 to 10 years. Stagflation and rising nominal interest rates could easily weaken bonds and equities simultaneously. Longer term investors with more flexible mandates have less reason to consider allocating to bonds and will look towards alternatives. The recent rise in the Barclays Aggregate and the S&P500 correlation provides credence to this thesis.

A 60/40 portfolio of the MSCI World and Barclays Aggregate lost 5% during April 2022, which is not shy of the 7.8% losses in March 2020. These are large losses for what is perceived by some to be a conservative investment, particularly given the share of the losses that are coming from bonds.

Extended financial pressure for traditional institutions could pressure authorities into fiscal and monetary support to ease the pain. However, it is pretty clear to me that troubles within these traditional institutions will remain a theme over the coming years. It is reasonably easy for authorities to force these heavily regulated entities to hold political sensitive assets like government bonds in order to keep yields lower than they would be otherwose. Crypto allocation becomes increasingly compelling in this context, particularly as regulatory cover emerges. As an example, Australia recently announced a bitcoin ETF and clearer regulation for the asset class.

Monetary and fiscal support possible to assist traditional institutions but they will remain in the firing line because someone must act as the bag holders of government debt. Crypto allocation becomes compelling in this context.

USDJPY Strength as BoJ commits to yield curve control

While US interest rates are being pressured higher by the highest US CPI inflation since December 1981, Japanese inflation has not risen by as much. The April CPI reading was 1.2% and after years tackling deflation this does not quite cut it for the BoJ.

The BoJ remains committed to Yield Curve Control (YCC) anchoring the 10-year yield at 2.5%. Continued defense of this yield cap implies the US-Japan 10 year yield spread has risen furiously over the past quarter. This type of aggressive monetary stimulus with absolute disregard for the implication on currency markets shows us what to expect in the US from the US Fed in the future. The Fed tends to follow the Japanese monetary policy playbook with a few year lag.

For now, the US-Japan yield differential continues to rise and the USD dollar is undeniably attractive vs. the JPY so the currency pair has broken out to its highest levels since 2002.

USD strength could trigger a liquidity event

The USD is also strengthening aggressively vs. the EUR and CNY, creating quite a cocktail for financial markets to contend with. We may be in the midst of a monetary regime change, but the USD is still the global reserve currency. USD strength tightens financial market conditions markedly and poses liquidity risks for financial markets. This remains the biggest risk to bitcoin over the coming quarter. Moreover, the correlation between bitcoin and the US dollar is strong at the moment so it would be foolhardy to ignore these risks despite the improving bitcoin fundamentals.

Bonds could strengthen at some point over the coming months, if we experience a liquidity event and a rush towards the USD, but I expect this will be short and sharp opportunity for traders rather that a long-term bond buying opportunity. If it transpires, it will present a generational BTC buying opportunity because bitcoin could weaken sharply. But the sharper the liquidity shock, the stronger the eventual central bank response and the sharper the bitcoin recovery.

Long-term holders are looking through short-term volatility

Despite the challenging macro climate, long-term holders continue to buy and hold bitcoin. Our medium term liquidity indicator has risen sharply over recent months, which suggests addresses are becoming biased towards holding rather than speculating. Additionally, coins are being moved off exchanges which is another indication of a preference for holding rather than speculating. Both of these serve as indicators of improving bitcoin fundamentals. I expect bitcoin will respond aggressively at the first sign that central bank policy is shifting. And until such time as there is a liquidity event, this perspective is a factor keeping bitcoin reasonably well supported as long-term investors look through any short-term volatility. This support is displayed in the ratio between bitcoin and the Nasdaq which has developed a upward slope since the July 2021 bitcoin price bottom.

In reality there has not been a huge amount of changed in the past month. The long-term bitcoin outlook remains strong but the short-term risks remain intact. Liquidity continues to be drained from traditional financial market, which is finding expression in bond and currency markets. Bitcoin is holding up pretty well in the face of these pressures, but it is not a time to get complacent. A full-scale liquidity event remains a reasonable probability event and the negative impact on crypto prices could be severe. Nevertheless, I doubt that bitcoin will spend much time below $30K. Many long-term investors are looking through this volatility and buying bitcoin below $40K because the eventual central bank response will inevitably be tilted towards further loosening. If that liquidity event transpires and the bitcoin price falls sharply, deep pocketed institutional investors will be ready to soak up liquidity en masse.