Market Review (July 2022): Marathon, not a Sprint

July was a more encouraging month for crypto participants with a 20% rebound in the price of bitcoin, the strongest monthly gain since October 2021. ETH rallied almost 60% on the month heading into the merge (when the protocol becomes entirely PoS). Crypto required the cover of equity market strength in order to stage a recovery in July, which is a concern, but below the surface bitcoin is searching for a bottom and capitulation is underway. Speculators are betting that the bottom might already be in, and there is good reason for this position but false starts and shakeouts need to be watched out for. TDLR: This is a marathon, not a sprint. These are great levels for long-term investors to build allocations. However further volatility should be expected over the coming months.

Conclusions

Bitcoin is finding support at psychologically important 2017 all time highs

Capitulation is clear in the data, suggesting that a bottom is forming

Miners are also capitulating, which tends to happen later in bear markets

The Fed is closer to capitulation but liquidity stresses are rising

Speculators could be creating a shakier foundation through overuse of leverage

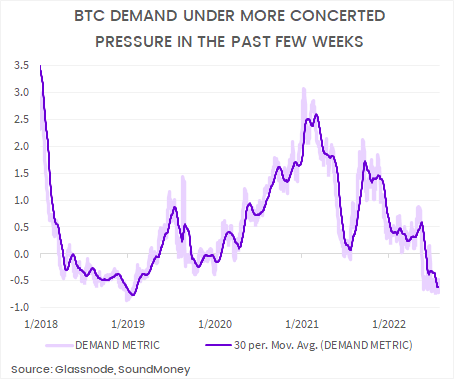

On-chain demand remains weak so cautious optimism is required.

Capitulation and support as bottom forms

After a painful three months between April and June 2022 where bitcoin fell 58% from $46.3K to $19.3K, bitcoin found price support at its December 2017 all-time high around $20K. This is an important psychological level because the break above this area in December 2020 was a clear confirmation of a bull-market. Bitcoin has now effectively retraced the full bull-market rally, which has not happened in its history before and suggests that this is a very deep bear market. Many investors will never have experienced a bitcoin price below $20K so it is no surprise that those who are disposed towards long exposure could see this as an area of value. Buying interest was found here as investors wonder whether capitulation is behind us.

We have spoken about capitulation numerous times in the wake of the Luna unraveling, 3 Arrows Capital failure and Celsius bankruptcy, and the resulting forced selling so lets quantify this with data. On-chain blockchain data allows us to measure the profit and loss at which bitcoin’s are traded. Data shows that many bitcoin holders have realized sharp losses in recent months. The levels on the indicator below are comparable to periods where bitcoin has bottomed in the past. Obviously the precise reading of capitulation on the indicator varies so we cannot rule out further capitulation but this is an interesting sign-post the capitulation could be leading towards a bottom.

Bitcoin miners are also capitulating. Mining difficulty and hash rate are both falling, which suggests that some miners have become unprofitable and have taken their equipment off-line. Miners usually act as a pro-cyclical force for bitcoin. During bull-markets, miners take a leveraged approach to bitcoin by hoarding newly mined bitcoins in the expectation that the cycle will continue. During bear markets, miners are forced to sell-off inventory (bitcoin and mining equipment), which accentuates bitcoin’s price declines until their inventory is exhausted. Further weakness cannot be ruled out when this indicator triggers as miners sell down on their bitcoin inventory, but it does signal that we are approaching the deepest portion of a bear market.

This data suggests that a bottom is forming and these are great levels for long-term allocations into crypto markets. However, it does not imply we have 110% confidence that the bottom is in. Patience is still required and (for those who are more active in short-term) potentially profit-taking too, if the rally becomes exuberant and over-heated.

THE FED is HEADING TO CAPITULATION but watch out for INTERBANK STRESS

That crypto gains needed the to cover of equity market strength in July to rally is not a wonderful feature of the market at present. As I have stated many times before, I expect the correlation to eventually break, but it has not broken yet. We are still at the mercy of macro and equity market sentiment.

Our macro indicators are bottoming and the July FOMC confirmed that the Fed is bound to take a looser turn in 2023. But the truth is that macro conditions and the Fed have not turned yet. The US economy is entering a recession and the Fed could begin easing monetary policy before the end of the year, but they have not started easing yet. Inter-bank stress measures like FRA-OIS spreads (chart below) are ticking up at the moment so we cannot rule out a liquidity event in traditional financial markets. If this were to take place, bitcoin could easily test sub-$20K levels and potentially the $15K region, but price is unlikely to spend much time there and those who are not sitting in front of the trading screen are very unlikely to execute at these levels.

Are short-term Speculators creating a fragile foundation?

While there is a lot to be positive about in cryptoland at the moment, it is concerning to the see the steady rise in trading leverage. Simultaneously, funding rates have ticked noticeably higher which suggests aggressive speculators are betting on crypto rebound. I appreciate the optimistic sentiment, but leverage creates a shaky foundation because it can be liquidated even quicker than it is created. Leverage has risen particularity sharply on ETH vs. BTC, which makes me a little sceptical of the ETH outperformance vs. BTC heading into the merge. Added to this, bitcoin dominance has languished on the back of the ETH driven rally. It is possible that the merge causes a market structure break, raising its importance as a collateral asset in crypto vs. BTC, but I would prefer to receive confirmation that this technical upgrade is complete before adjusting.

The other side to the leverage coin is actual on-chain transaction activity, which measures real economic health of the network. It is possible that demand lags at bottoms, but nevertheless it would be preferable to receive confirmation that real economic activity is swinging higher again before conclusively determining that the BTC bottom is in the past.

We have been speaking about the forming bitcoin bottom over recent months and July provides further evidence thereof as capitulation is clear from holders and miners. These are great levels for long-term allocation into the space. Those that are feeling cautious and overthinking the decision making process could probably do with a little more gusto. However, this does not imply that we’re returning to new all time highs any time soon. There are tones of obstacles to overcome in the coming months, including interbank stresses in trad-fi, weak on-chain demand leverage. There is a real possibility that active traders and funds are pushing hard in the hope of making up for losses incurred earlier in the year and there could still be some pain and false starts. The best approach is definitely to pull back the lens, appreciate the long-term value of the technology and opportunity presented by prices sitting close to Dec 2017 all time highs. Leave the shorter term prognostications for those who follow these markets each and every day.