Market review: BTC hits $30K resistance as Banking Crisis deepens

It was a quiet month for asset class returns but there have been a couple interesting developments in the trad-fi banking crisis and Operation Choke Point as BTC consolidates at $30K. TLDR: We suspect that further gains are probable in 2023 as the chances of Fed intervention increase in the face of a banking crisis, but weakness towards $26K would be a healthy market event.

As we suspected last month, trad-fi is not out of the banking crisis woods

First Republic Bank (FRB) failed and was swallowed up by JPMorgan Chase. FRB was a bigger failure than SVB and Signature, putting this crisis on a similar scale to 2008.

Source: Mike Bostock

Until the Fed finally capitulates by lowering interest rates and expanding its balance sheet to new heights, there will likely be more bank failures in 2023.

The Fed’s balance sheet is expanding but nothing like 2008 or 2020 yet. We expect a comparable increase in the balance sheet in the next year.

The Nasdaq Bank index looks like it is in deep trouble, supporting our thesis that there is more trad-fi banking pain to come. Pacwest Bancorp looks like it might be next in line.

Crypto is sandwiched between two opposing forces here:

In the longer term more liquidity and lower interest rates are inevitable, which will push the prices of scarce digital assets higher

Shorter term, the Fed is still trying to avoid throwing the kitchen sink at markets so risk appetite is somewhat restrained after a strong rally in risk assets this year already.

As we have mentioned before, crypto developers need to forge new use cases and better user interfaces in order to attract new participants into the market for the next bull-run. There is some indication that this is underway. For example, ordinals have bought a deluge of new innovation to bitcoin, reigniting excitement from some crypto natives who had previously written off the project as boring.

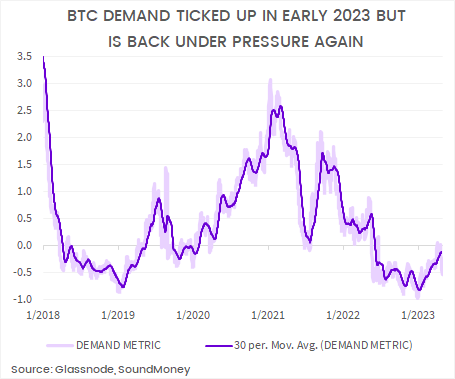

However, on-chain transaction volumes and new address growth suggest we have not yet reached the stage where new participants are blindly rushing into the market so caution must still be practiced.

BTC has run into resistance around the $30K mark. We suspect that further gains are probable in 2023 as the chances of Fed intervention increase. But weakness towards $26K would be a healthy market event, setting up the potential for bigger gains in H2 2023.

Before departing, it is worth noting that Operation Choke Point continues despite growing opposition from certain quarters in Congress. Post the failure of Signature and Silvergate Bank’s, authorities continue to place pressure on any banks servicing crypto customers. Additionally, the Presidency has proposed a 30% tax on crypto miners.

These efforts to clamp down on crypto mining will not meet the stated policy objectives. Authorities saw that they want to reduce carbon emissions, but emissions would increase under this tax because miners would likely move offshore to jurisdictions where there is even less consideration for the environment. The best thing the US government could do with crypto policy for the environment would be to support miners utilizing renewable energy. But, as we have pointed out before, this attack on crypto is not founded in logic so we should not expect anything other than brain-dead arguments from authorities. Our job is merely to point out the faulty logic and hope that readers will be able to utilise the brains that have been bestowed upon them.

For further reading on the motivations behind the actions of US regulators, read our recent piece CBDCs: Incumbents market failing product to maintain control ahead of fiscal crises.

Until next time.