Short-covering could trigger sustained reversal

Bitcoin’s increasingly narrow low volatility price range between $18K and $24K needs to come to an end eventually. We are biased towards the upside because research tells us that the worst is behind us in this crypto cycle. However, that does not imply that we are off to the races in a new extended bull-market yet. TDLR: Short-covering appears to have trigger an upside break of a declining volatility range and we expect it may continue into the mid-$20K’s.

Conclusions:

Crypto volatility is low, particularly vs. the S&P500 - synonymous with late bear markets/early bull markets

Leverage rose during the $18-24K BTC price range which suggests higher volatility is possible

Upside price breakout can trigger extended short covering, causing further price increases

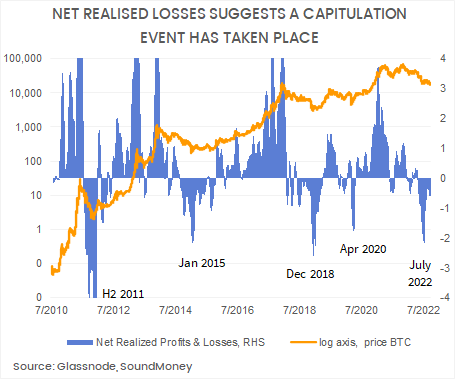

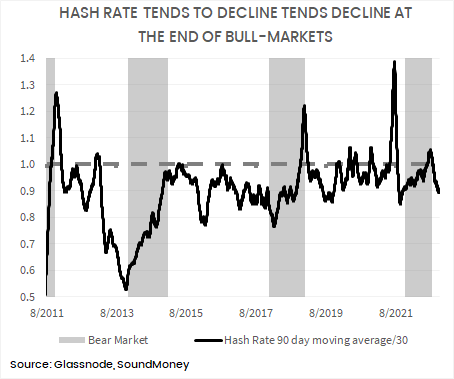

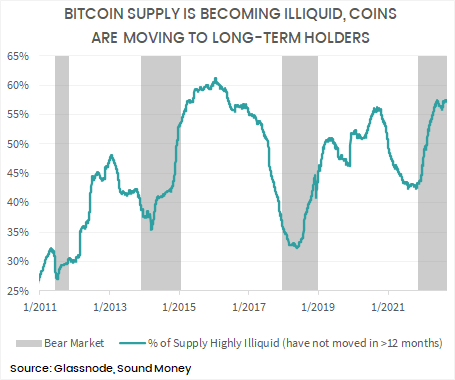

Upside bias because of price capitulation, BTC miner capitulation and long-term holders supply dominance

Since mid-June BTC has traded in an increasing narrow range between $18K and 24K. Price repeatedly tested support at $20K and failed to break to lower levels. Crypto volatility declined sharply during this period. It is very rare for bitcoin volatility to maintain these extremely low levels.

Crypto volatility was particularly low in comparison to equity market volatility. The spread between BTC realised vol and the S&P500 fell to some of its lowest levels on record. It is also rare for this spread to remain at these levels for any length of time. It is far from perfectly predictive but BTC volatility tends to drop relative to the S&P500 near the end of BTC bear markets or during the early stages of bull-markets, which adds another piece to the growing body of evidence that the worst of this bitcoin cycle is behind us.

While volatility was declining, leverage built up during the price consolidation as investors took directional bets in expectation of a breakout. We remain biased towards the upside breakout scenario.

We do not try to precisely forecast the market bottom, because this commitment to a price expectation can impair our judgement going forward. But our research shows that there is a reasonable probability that the worst is behind us because July marked a large BTC price capitulation event, BTC miner capitulation has taken place and long-term holders dominate supply.

Sure enough, a relatively small price increased caused larger liquidations as short positioned traders were forced to cover their exposure, triggering a bigger run up in price in the past week. This price increase may lay the foundation for a reasonable rally in the next couple of months that could potentially last longer than initially expected.

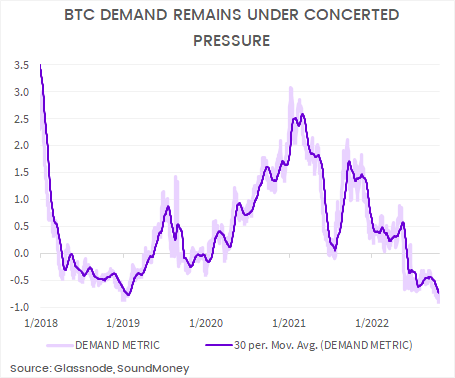

Does this imply that the bottom is in and we are off to the races? No. Traditional macro conditions remain poor, the Fed is not actually loosening policy yet and on-chain BTC demand is weak, which suggests that there is not a lot of new entrants entering the space at the moment. So there are reasons to be cautious and take profits if price action becomes exuberant over the coming weeks.

But market do not move in a straight line. The market is now speculating on the date of a pause to Fed rate hikes and we have said for a long time that crypto will be one of the first asset classes to price the change in sentiment. We expect that a relief rally in equity markets and weakness in the dollar index could contribute towards crypto strength into year-end, which is seasonally a constructive period for price historically, particularly November. We think the mid-$25K region is possible, perhaps higher, and see additional support for this view from the tightening in short-term exchange liquidity over the past month.

Plus, the reduction in the correlation between equity markets and BTC is a developing positive to keep an eye on.

Markets tend to move in such a way as to catch the maximum number of participants off-sides. We expect a somewhat extend rally into the mid-$20K’s, perhaps higher, would catch a number of participants off-sides after a few months of choppy price action with low volatility and negative sentiment. If the Fed has not committed to looser monetary policy by then, its very possible that the rally loses steam but we will assess the change in conditions as they develop. We think the risk-reward remains tilted firmly towards the upside here.