Crypto Crystal Ball: 2024 predictions

As we embark on another exhilarating year in our pursuit of a Sound Money world, let's take a moment to reflect on 2023 and cast our gaze forward to what 2024 holds. In this note, we’ll touch on last year’s predictions, gaze into our 2024 crystal ball and include a few comments about current conditions.

2023: A Year of Surprises and Lessons

Predictions from 2023

Bitcoin's Rally: In 2023, Bitcoin outperformed even our most optimistic predictions. This surge underscores the dynamic free market nature of this market, its ability to flush out the bad actors and its penchant for surprises. This serves as a great reminder not to underestimate the power of this monetary regime change!

Regulatory Landscape: Despite a significant shift towards crypto-friendly court verdicts in the US (Ripple, Grayscale) and the near-approval of the Bitcoin ETF, the lack of new regulatory frameworks in the US was a bit of a letdown. Perhaps changes in the US Presidency, House and Senate will keep the positive momentum intact

Bitcoin Dominance: Bitcoin's dominance surged as anticipated, but Ethereum's performance fell short of expectations. Stablecoin: adoption and utilisation was impressive in 2023. Decentralised exchange (DEX’s) adoption was disappointing, however. We will touch on these more below.

Looking Ahead: Key Predictions for 2024

Bitcoin ETF & Market Dynamics: The long-awaited sport Bitcoin ETF is a monumental step for adoption. The spot ETF allows investors to efficiently hold bitcoin within their existing custody structures. This is big news for institutional adoption because many institutions are unwilling to appoint new custodians. It will have a negative impact on the centralisation of holdings because all ETF issuers are utilising Coinbase. However, increasing familiarity should positively impact regulatory outcomes and bitcoin’s principles of decentralisation, scarcity and transparency should infiltrate.

Despite the good news, we anticipate a fair amount of froth has entered the market, which may need to be flushed out and cause price weakness in Q1 2024

Futures funding rates reached some of their highest levels since Q4 2021

Bitcoin Dominance has retreated in the past month as capital has flooded into altcoins

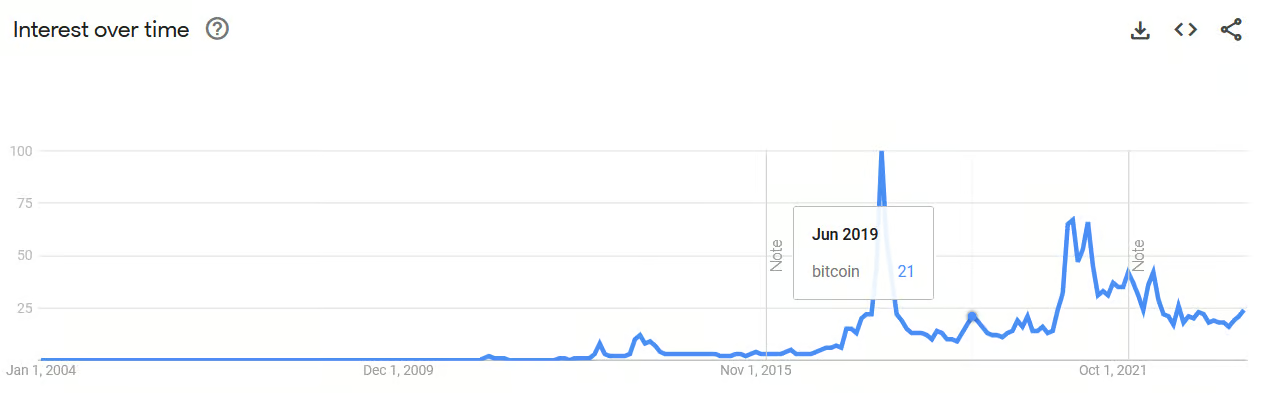

New interest will almost certainly rise to far higher levels during this cycle, but current levels of Google searches for "bitcoin" are comparable with the June 2019 local peak in bitcoin, which saw the end of the post-2018-bear-market rally.

Underlying on-chain demand remains weak, which is a sign of caution

Cyclically, we ran a little hot in 2023, particularly when you consider that this is the second longest period in bitcoin's history without 25% drawdowns

Despite a more cautious start to the year expected vs consensus, we predict a strong year thereafter with Bitcoin potentially surpassing $80K.

Energy Consumption Debate: The environmental impact of Bitcoin mining will remain a hot topic amongst bitcoin's critics. However, we predict a surge in the use of Bitcoin miners for central heating and further utilisation of Bitcoin Miners for renewable energy. These demonstrations should put another nail in the coffin of “what is it even useful for” critiques.

A practical example of bitcoin miners providing heating solutions (Source: Morning Brew)

Stablecoin Developments:

Tether becomes more transparent, regulated and accepted

Numerous new regulated stablecoins issued across globe, included UAE

Stablecoin activity increases sharply on SOL, utilising its low cost and high throughput architecture

US govt passes stablecoin regulation

Numerous consumer based payment providers utilise stablecoins for execution and users are none the wiser about the stablecoin involvement

Ethereum's Resilience: After potentially further relative weakness in early 2024, Ethereum is expected to make a strong comeback, breaking through 0.08 later in the year.

Bitcoin Layer 2's: Ordinals highlight the prospects for non-monetary use-cases on bitcoin. We expect increased activity on bitcoin layer 2s and progress with decentralised financial use-cases on top of bitcoin, like lending markets.

BNB's Market Position: We foresee Binance losing ground as it struggles to keep pace with other market players amidst increased regulatory scrutiny

Decentralized Exchanges (DEXs): Despite a slow 2023, we're bullish on DEXs and predict DEX volumes will rise above 25% of total exchanges volumes this year

We are especially bullish on decentralized BTC swaps on platforms like Rune.

In 2023, events like the US banking crisis, hyperinflation in Argentina, and an increasingly fractious geopolitical landscape underscored the critical need for a neutral, borderless financial infrastructure that holds its value and resists censorship. Against this backdrop, Sound Money Capital's dedication to 'the challenge and opportunity of our lifetime'—Sound Money—has never been stronger. We are committed to helping our clients and community navigate this powerful technology and exhilarating market. Our focus on delivering high-quality content and informed decision-making has been instrumental in creating tangible value for our clients, a testament to our expertise and dedication. If you are looking to understand more about our unique approach please feel free to reach out to us. We are excited about the prospect of engaging in meaningful discussions and discovering new opportunities together in 2024.