BTC breaks $40K, retraces 50% of Bear Market

Bitcoin has continued its merciless rise above $40K in early December and has now retraced 50% of the bear market. Trad-fi macro conditions improved further in November, something BTC has been predicting for many months. Regulatory and systemic uncertainty was also reduced in November as clarity emerged at the world’s largest crypto exchange, Binance. This is an exciting time in crypto land ahead of the impending spot ETF approval. Broader market interest will begin to pick up as bitcoin catches headlines. The probability of price retracements also increases at these levels. TLDR: The bitcoin ETF is a clear driver behind remarked BTC strength and the 6-18 month outlook remains very constructive, but there is a risk price becomes stretched as we launch into the high $40Ks.

Conclusions

Financial conditions loosen sharply in November (DXY down, Yields down)

Another aggressive bitcoin-led rally in early December (BTC>$40K)

Reduced Binance uncertainty after settlement with DoJ, Treasury and CFTC

Binance clarity further increases the probability of a spot bitcoin ETF approval

Bitcoin has retraced 50% of bear market - cooling off possible at these levels

BTC gains continued in November 2023 as price ground higher before eventually exploding higher in the first few days of December. ETH and other altcoins caught up to BTC during November, confirming the opening salvo of a shift towards high-beta assets. However, the December rally has once again been Bitcoin-led, highlighting the health of the market overall. Remember, we view BTC as the foundation of the ecosystem and high BTC dominance generates positive expectations for returns in the next 6-12 months.

Loosening in Financial Conditions

In traditional financial markets, bonds could be bottoming, the dollar may have topped and the yield curve has started to steepen more noticeably. The Goldman Sachs Financial Conditions index reported its largest monthly easing on record in November. These macro factors should provide support to risk assets over the coming quarters. The way we see it, bitcoin has been pricing the loosening in financial conditions for the last year because it is the most responsive asset.

Source: @Marlin_Capital on twitter

Bitcoin has retraced 50% of bear market

Bitcoin has now retraced 50% of the bear market. Just take a moment to let that sink in…FTX, Luna, BlockFi and Celsius are all behind us. There is now an argument to be made for some cooling off, or perhaps a rotation into non-bitcoin crypto assets. Perhaps we reach up towards $47K but some degree of consolidation or retracement increases in probability at these levels

We are aware that the bitcoin spot ETF could continue to drive flows and our short-term liquidity indicators have tightened again, which is constructive for price, so we will watch closely for technical confirmations of changing trends.

Reduced Binance uncertainty

On the crypto news front, Binance pleaded guilty to violating anti-money laundering laws. The world's largest crypto exchange settled with the DoJ, Treasury and CFTC for $4.bn. Binance's CEO CZ stood down after pleading to felony charges.

The fine is one of the largest in US financial history but the actual AML conviction is not as problematic as some suspected. In June 2023 we said,

Longer-term, the Binance case may also generate clarity, but in the shorter term there are a number of uncertainties to wade through and these cases could also take a long time to resolve so the doubts could persist for some time. The SEC is alleging that Binance's BNB token is unregistered security. Most damming is the allegations that Binance misled investors. It is possible that Binance's claims of consistent over collateralization are false and that client funds were used to secure debt. Fraud, commingling of client assets and manipulative trading will remind many of FTX, creating a degree of fear in the market.

Both of these cases will likely take a long time to resolve. Not much is going to change in the short term. A sharp shift in Binance balances would raise Binance FTX fears and is certainly worth monitoring. And while these fears have some credibility, they do not appear to be of nearly the same magnitude as FTX. The hopeful argument is that the SEC case causes Binance to conform to more transparent business practices.

We were incorrect in our concern that it could take a long time to clear up Binance's opaqueness. We however been prescient in our suggestion that FTX fears were unfounded. Our 'hopes' have been fulfilled - Binance has agreed to be monitored by the US government for the next 5 years. We expect BNB (Binance’s token) will continue to underperform its peers in the face of the regulatory oversight and leadership changes.

Further transparency within the crypto industry after FTX's bankruptcy and SBF's conviction is certainly welcomed. Binance's settlement also further raises the probability of a spot bitcoin ETF approval in the US. Regulators may now be appeased that this proverbial gorilla is no longer able to jump out of the closet.

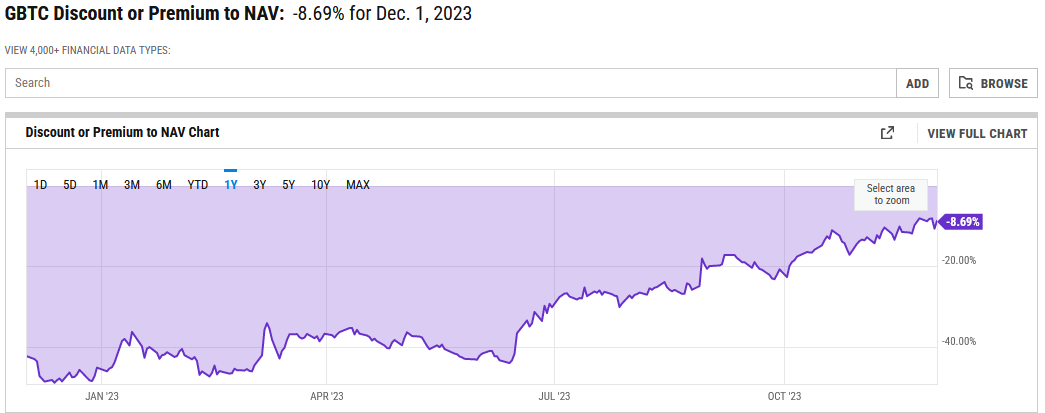

The impending bitcoin ETF approval remains a key driver of bitcoin strength. Further evidence for the ETF approval probability can be seen in the narrowing of the Grayscale discount to BTC as speculators price an increased probability that the trust will be converted into a spot ETF (Grayscale’s trust currently has no redemption mechanism, which created the discount to BTC)

Source: ycharts