Bitcoin's Bold Breakout

Bitcoin has decisively broken its low volatility shackles with an aggressive rally through $30K. Focus has firmly turned towards the high probability of spot ETF approval and the bitcoin halving in April 2024. Not only has bitcoin broken its correlation to equity markets, but its correlation to gold is elevated, serving as further confirmation that cyclical conditions have shifted. Long-term bitcoin holders remain resolute through this rally, indicating that it has legs. TLDR: Bitcoin has entered the next phase in this cycle - its outperformance signals foundational strength for the forthcoming bull market and potential improvement in high-beta assets

Fake ETF news triggered rally, signaling under-allocation

October witnessed an impressive 26.6% surge in Bitcoin's value, fueled by a fake ETF approval announcement. While this news was eventually debunked and Bitcoin's price temporarily receded, the sharp rally highlighted that many investors were under-allocated.

With numerous SEC deadlines due in Q1 2023, it increasingly likely that an ETF approval is on the horizon in the next quarter, a significant development to watch for.

Source: Be(In)Crypto

Decisive break in correlations: BTC is a store value, not high-beta

We have been harping on about correlations for a while now because it is crucial to confirm that bitcoin is not high-beta equity. October well and truly rammed this message home as bitcoin outperformed the S&P500 by almost 30%.

Bitcoin’s correlation with gold has been more prominent in recent months, highlighting that it is acting more like a store of value.

Cyclical conditions remain constructive

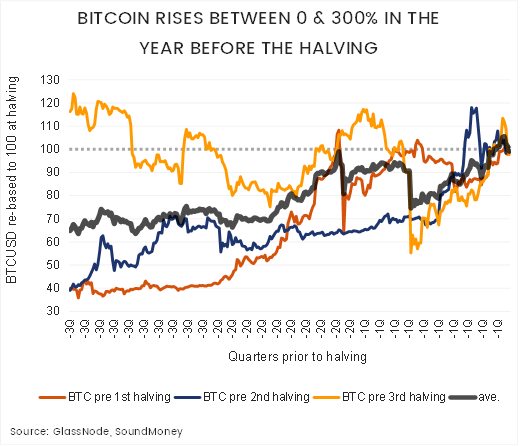

While the ETF news acted as a catalyst for the rally, it's essential to take a step back and acknowledge that cyclical conditions have been steering us toward this possibility ahead of the 2024 halving event.

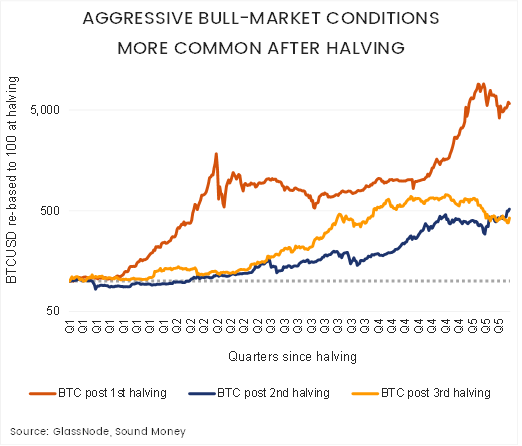

Historically, Bitcoin tends to gain momentum leading up to halvings, with more exponential returns typically materializing post-halving. The interplay between increased demand from the ETF and reduced supply from the halving creates a powerful mix, suggesting that more exuberant conditions may emerge in H1 2024.

Long-term holders have been resolute through the rally with very little profit taking. No surprise here – knowledgeable participants are expecting higher prices in the coming quarters.

Higher bitcoin dominance points towards potential high-beta outperformance

Bitcoin's impressive outperformance in the past quarter has propelled its dominance of the market. This not only reflects a healthy crypto market but also hints at the likelihood of non-BTC assets outperforming in the near future.

In addition to Bitcoin, we are excited about several projects that have not only shown fundamental and theoretical promise but have also demonstrated relative strength compared to Bitcoin. These include Rune, SOL, and LINK. If you'd like more detailed insights on any of these projects, please feel free to reach out for fund-specific commentary.