BONDS REFLECT MONETARY REGIME CHANGE, YET CRYPTO SUPPORTS USD

September witnessed crypto strength with Bitcoin (BTC) rallying by 8.4% from $25.8K to $28K. Equity markets faced headwinds due to the strengthening USD. The divergence between equities and crypto underscores the noteworthy shift in correlation dynamics, affirming that Bitcoin is charting an independent course. In this month's article, our spotlight turns to an indicator of monetary regime change presented by global bond markets. TLDR: While the cryptocurrency landscape undoubtedly poses a challenge to fiat currencies during this monetary regime change, crypto, through stablecoins, is simultaneously reinforcing the dominance of the USD amongst fiat currencies.

Key Insights

Crypto strength in the face of equity weakness

Bonds fail to reflect recessionary risks seen in PMI

Shifting bond dynamics point towards monetary regime change

Crypto supports USD through monetary transition via stablecoins

Stablecoins prominence within crypto and tradfi is astounding

US government will eventually support stablecoins, similar to eurodollars

Stablecoins present major risks for Emerging Market currencies

Macro conditions continue to keep a lid on risk appetite

Bitcoin fundamentals are strengthening ahead of potential spot ETF approval

Bonds reflect monetary regime change

Bonds experienced another challenging month with the Barclays Aggregate falling 2.9% and the weakness has persisted into early October. Longer-dated yields rose more than short-dated. The steeper yield curve suggests that the economic cycle is shifting from flattening towards steepening, which is better for liquidity-sensitive assets like crypto and oil.

It is fascinating to observe the breakdown in the correlation between the 10-year bond yield and growth/inflation expectations as measured by the ISM Purchasing Managers Index (PMI).

When the PMI is above (below) 50 it displays expanding (contracting, i.e. recession) business conditions. Traditionally recessionary conditions will embolden market participants to buy bonds in expectation of lower interest rates, hence lower yields.

That we have not seen lower yields likely tells us that the primary buyers of Treasuries have less desire to do so. The cause for this shift is likely related to persistently wide fiscal deficits, extensive Fed balance sheet expansion and policy mistakes in Russia when the Treasury decided the sanction Russia's Treasury assets.

We still expect there will be a period in this cycle where the correlation between yields and growth/inflation picks up again, i.e front-end yields will likely decline sharply when the Fed starts lowering interest rates. But the clear correlation breakdown we are currently witnessing is another signpost in the on-going monetary regime change. Another confirmation of this shift can be seen in foreign central bank gold purchases, which we covered in Central Banks are preparing for a monetary regime change, are you?

This regime change does not imply that the dollar's status as global reserve currency is under imminent threat. Realistically, there are no clear contenders for the dollar’s throne. But below the surface, there is plenty of jostling and posturing as the need to find a new monetary order is paramount. Neutral financial infrastructure like bitcoin is poised to excel in this evolving landscape.

STABLECOINS support DOLLAR reserve status

We often discuss monetary regime change so I want to highlight a reason why this shift is not necessarily dollar-negative in the next 5-10 years. Stablecoins have emerged as a powerful tool to expand the dollar's reach, which was the focus of Nic Carter's excellent presentations at Token 2049 and Mainnet this year.

Similar to the 1950s emergence of eurodollar for USD transactions outside of the US, there is a clear demand for stablecoins. Relative to BTC and ETH, stablecoins account for approx. 14% of market cap and 27% of transaction volumes.

Annual stablecoin volume rivals Visa, signalling their growing significance in the financial ecosystem.

Source: Simon Taylor

Stablecoins also appear to be following a similar path to eurodollars with flexibility and yield driving growth. Eurodollars, like stablecoins, were initially viewed sceptically by the US government but today the Fed supports foreign central banks with USD swap lines whenever non-US DM financial institutions experience sharp USD shortages.

Nic Carter agrees with our longstanding argument that eventually the US government will also take a supportive approach to stablecoins. Apart from the desire to have oversight of this growing segment of global financial markets, Treasuries need to find new buyers because foreign buyers have been divesting from Treasuries since 2013

Source: Castle Island Ventures, Nic Carter

Stablecoin issuers hold US Treasuries in reserve for all the coins issued and thus they could become a large buyer of Treasuries in the future. If all stablecoins were 100% Treasury backed, they could be approximately the 16th largest holder of USTs today

Source: Castle Island Ventures, Nic Carter

In other words, it is strongly in the interests of the US government to support stablecoins and thus I think it is almost inevitable that it will happen.

Speculating further into the distance, in 10 years time I expect the USD volumes will be higher vs. fiat currency peers, assisted by stablecoins on crypto rails. The Turkish Lira, Nigerian Naira, South African rand, etc. will still be required for domestic taxes, but crypto provides consumers with the opportunity to seamlessly hold a mix of bitcoin, ethereum and USD stablecoins. Far fewer people are going to hold significant portions of their savings in volatile EM currencies that all depreciate vs. USD, BTC and ETH over time.

Market Outlook: Crypto is caught between two opposing forces

Macro conditions are poor and have deteriorated further over the last month as seen from rising yields and a stronger dollar. Equity markets have held up pretty well, which is probably related to the fact that investors are loathe to shift capital into bonds. Nevertheless, global risk appetite is constrained, keeping some pressure on crypto. That being said, bitcoin is now singing more to its own tune and these risks could matter less.

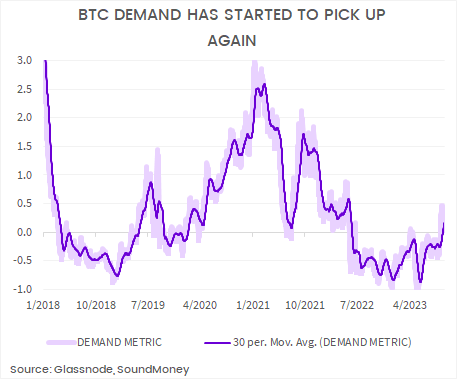

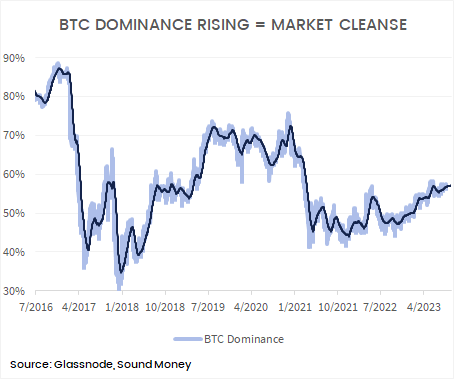

In contrast, Bitcoin internals continue to improve. Demand ticked up nicely in the past month, the strongest levels we have seen since the bear market. Long-term holders remain a key factor supporting the market and bitcoin dominance has continued to edge higher, which is also constructive

The prospects for a spot bitcoin ETF approval in the US remain strong after the District Circuit Court's ruling against the SEC in recent month. We don't expect bitcoin market weakness will last for much longer. Seasonality also suggests the tides could be turning with September now behind us. Perhaps there is one last tradfi-induced liquidity squeeze but $24-25K will be wonderful levels to add exposure if they emerge again.