Run Forest Run - Bitcoin Loves a Banking Crisis

The recent banking crises, highlighted by the failure of Silicon Valley Bank (SVB) and Credit Suisse, have once again exposed the fragility of the traditional financial system, causing the biggest and fastest bank run in history. At the same time, Elizabeth Warren and other US politicians have launched a direct attack on the only viable monetary solution, crypto. However, this opposition has had little impact on truly decentralized crypto applications like Bitcoin and Ethereum, which are running smoothly despite the political opposition. In fact, the attacks on centralized crypto companies make the industry more resilient as it becomes less reliant on centralized entities. We expect many will continue to run from trad-fi to crypto in the years ahead. TLDR: Liz Warren’s attack on the crypto industry strengthened bitcoin’s value proposition, highlighting the ever-present bank run risk within illiquid and highly leveraged banks.

Luddite Liz doubles down against technology & innovation

As we suggested last month, certain sections of the US political establishment do not like crypto and are attacking it directly. In March, Elizabeth Warren declared outright war on crypto, confirming what we previously noted. In the years to come, this behavior will appear as ridiculous as the Luddites who attacked cotton and wool mills in the early 1800s. Revolutionary technologies like spinning machinery, the steam engine, or the printing press have met political opposition because they are disruptive and unseat incumbents.

Luddites attacked the revolutionary technology of the 1800s, wool wheels.

Source: CBS News

Bitcoin unleashed a new technology of scarce decentralized digital assets into the world. Just like the revolutionary technologies of the past, bitcoin and other truly decentralized financial applications cannot be stopped. Imagine trying to stop the telephone, internet or combustion engine... Many people tried and failed. The proverbial rabbit is out of the bag. People do not stop using superior technology once it is available.

Governments' inability to stop bitcoin is quite clear when one assesses the actions of Liz Warren's army in recent months. They have attacked centralized crypto companies and banks that service crypto companies. All of these actions are undesirable, but they have little impact on truly decentralized crypto applications like bitcoin and ethereum, which are running smoothly in the face of political opposition.

Bitcoin, like the honey badger, is renown for its resilience to attack from larger predators.

Source: Wikipedia

marketing spin on failing product by incumbents

As we have highlighted numerous times before, these types of attacks are also contrary to the stated objectives of regulators. Centralised crypto activity will move towards welcoming jurisdictions, away from the Liz Warrens of the world, making their regulatory actions less impactful. But perhaps narrative rather than logic is the driving force amongst regulators.

That bitcoin triggers certain sections of the political establishment merely confirms its importance. Ghandi’s quote suggests that we are closer to eventually winning the fight against centralized finance than we were in years gone by when politicians ignored and laughed at this nascent tech. I don’t think the fight will be a quick one however, and I doubt that the recent uptick in “central bank digital currency” chatter is coincidental. The incumbents are marketing their failing product and attacking the competitor. But as Peter Drucker said, "marketing is only as good as the product it sells," and the state issued monopoly money is not the best product in town.

It is no coincidence that ‘central bank digital currency’ chatter has spiked during the recent attack on crypto

Source: Google Trends

It is almost humorous that Warren et al.'s targeted attack on crypto triggered a bank run, a banking crisis, and contagion across the Atlantic, highlighting the underlying value of decentralized financial technology.

SVB & Credit Suisse Failures Highlight Systemic Banking Troubles

After Liz Warren’s anti-crypto army caused a bank run at Silvergate bank, depositors started fleeing out of Silicon Valley Bank (SVB) too. As a crypto focused bank Silvergate’s failure was humorous to Mrs Warren, but SVB was the biggest bank failure since the Global Financial Crisis, leading to sudden intervention by the Fed. The resulting banking contagion also bought to a close Credit Suisse’s 167 year history.

The way in which UBS was forced to swallow Credit Suisse to prevent a deeper banking crisis in March was absolutely breathtaking. Swiss authorities bypassed their own laws to ensure that UBS shareholders could not vote on the deal because they did not want any delays. UBS paid $2bn for CS, which is approximately 70% below the prior Friday's closing price. The Swiss National Bank loaned UBS $100bn worth of liquidity. In other words, Swiss authorities needed to do something with CS immediately to prevent banking contagion, so they went to UBS and forced them to purchase CS.

Clearly these banking failures are unrelated to crypto! Credit Suisse's share price shows that its failure is an ongoing saga since the GFC.

Here are a few of the factors negatively impacting banks:

Ultra-low interest rates have killed banks because they have narrowed the interest rate spreads from which they make returns. In Europe, negative interest rates have made the situation even worse.

Onerous post-2008 regulation constrained banks' ability to lend, hindering profitability.

Basel regulations force banks to hold poorly performing government bonds. In the US accounting treatment hid the Treasury losses by marking them as hold to maturity (HTM) instead of mark to market (MTM).

Deposits, the foundation of any bank, have been falling due to the attractiveness of higher-yielding money market funds. US banks have experienced the largest 2-year rolling drawdown in deposits in history this year.

The cold hard truth is that banking in its traditional format is a sunset industry. Banks do not fulfill the traditional role of safeguarding deposits. Banks are forced to hold government paper because no one else really wants to hold these assets, which means they are doomed to lose money over the long term. Bank’s clients are already leveraged to the hilt so it is not easy to stuff any further debt down their throats. Banks are highly leveraged and liquid institutions that constantly run the risk of bank runs. Online banking further exacerbates deposit outflow risks because customers can move funds at the click of a button. For context, SVB customers withdrew $42bn in one day. The previous biggest bank run was Washington Mutual bank in 2008, which totaled $16.7bn in 10 days.

Fully reserve backed stablecoins like USDC are probably far safer places to store capital than a bank because at least there is a high probability that the issuer holds the funds and has the liquidity to fulfill upon redemptions.

Fed tightening finally running its course

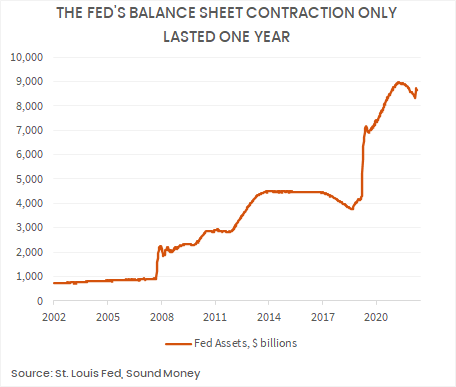

The Fed has been tightening monetary policy through late 2021 and 2022 but the financial system cannot survive for long without new liquidity injections. Something was going to eventually break and force the Fed to reverse course. SVB's failure in March led to a > $300bn expansion in the balance sheet which highlights just how quickly the Fed can reverse course when systemic fragility rears its head.

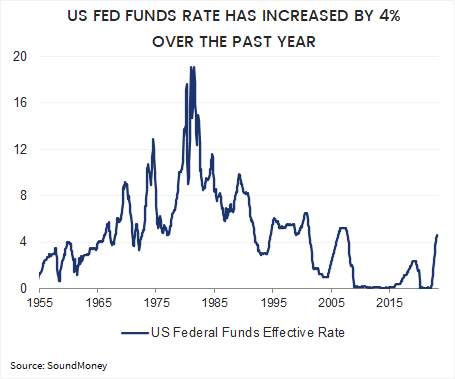

The Fed created a new monetary policy tool in March. The BTFP program allows all banks to borrow as much as they like from the Fed, using their underlying securities as collateral and they can value those assets at par. This does not structurally solve anything but unlimited liquidity is available to banks to sure up any funding challenges that arise. The Fed also opened up swap lines to central bank peers in March. This does not structurally solve anything either but it does provide the ECB with unlimited access to USDs to be able to lend to its troubled banks. I.E. A massive liquidity injection is possible. It is difficult to see how the Fed is going to hike interest rates many more times in these conditions. Perhaps we get a few quarters of higher rates but liquidity injections behind the scenes to maintain some semblance of stability but eventually interest rates will also reverse.

Systemic fragility highlights value of alternative monetary technology

I did not have a banking crisis on my radar for 2023 but we know the financial system is creaking and a monetary regime change is already underway so monetary flash points should always be expected. Bitcoin, as an alternative monetary technology, stands in stark contrast to the traditional financial system so it is no surprise to see prices respond aggressively to trad-fi fragility.

Bitcoin requires no outside intervention to maintain the ability to process transactions 24 hours a day, 7 days a week, 365 days a week. With self custody there is no need to worry that deposits will be fractionally lent. Bank runs can only take place with centralised entities like FTX and SVB.

It can be difficult and scary to see the financial system display such stress because there may be any number of real-world consequences. However, it is a relief to witness our long-term thesis play out in real-time.

STRONG BITCOIN FOUNDATION IN THE FACE OF Deepening trad-fi troubles

Does Fed loosening imply that we are off to the races and the worst of this financial crisis is behind us? It is difficult to conclude this with 110% confidence.

It is possible that this is the Bear Stearns event before the eventual Lehman's collapse 6 months later. The Fed conducted liquidity operations via TALF in late 2008 before eventually unleashing QE in March 2009. Another bout of trad-fi volatility remains possible in H2 2023 and is certainly a on-going risk for crypto markets. However, risk and uncertainty are not a reason to disengage from the market. We know that liquidity is being injected and investors are rushing into alternative monetary tech. It is powerful to experience this bitcoin-led rally in the face of a banking crisis because it serves as an important proof of concept. A liquidity event could easily take bitcoin back towards $20K but it is very unlikely that we mark new lows in 2023.

$32K bitcoin looks firmly in sight and $42K is not out of the question this year. We will have to remain nimble and assess conditions as they develop over the coming months. I am watching the impact, assessing the uptake on liquidity programs, monitoring stress measures like libor-OIS and watching the rates markets closely.

On the bitcoin front we are monitoring bitcoin profit taking for signs that long-term holders and cashing in on holdings. There is little sign of this yet so the price still has a reasonably strong foundation.

There has been a slight shift in capital towards exchanges, which could suggest that some participants are preparing to sell, but nothing alarming as yet. Perpetual funding rates are on the rise, but we have simultaneously seen a major reduction in open interest relative to market cap, which suggests that leveraged derivative markets are a far less important driver of price today than they have been in months gone by. I.E. funding rates are less relevant in this environment.

Conclusions

The US political establishment is marketing their failing product through CBDC’s and attacking the competitor, crypto

Liz Warren’s attack on crypto focused banks created contagion and caused the biggest bank run in US history

Banking is a sunset industry due to low interest rates, over regulation and failing monetary system

Fed tightening is coming to an end as banking crisis causes large unexpected balance sheet expansion

Bitcoin and the crypto ecosystem is the best viable alternative to our crumbling financial system

The probability of bitcoin retesting its 2022 lows are fading sharply as price accelerates above $30K