Embarrassed US Regulators FIGHTING AN UPHILL BATTLE AGAINST FINANCIAL FREEDOM

The Securities and Exchange Commission's decision to close down Kraken's staking business and Paxos's BUSD product will understandably be viewed negatively on newswires across the globe but a little bit of context is required. Certain sections of the current political administration have taken a reactive approach to crypto post FTX, but I do not see any major reason to be alarmed. Regulators were not very supportive during the Trump administration either and crypto has developed by leaps and bounds during this time. It is a pity that the US is not taking a more collaborative approach but innovation will continue - even if its outside of US borders. TLDR: Decentralised financial technologies remain difficult to regulate and the world needs this force for financial freedom so developers, entrepreneurs, investors and consumers will continue to experiment with it in spite of the more reactive approach to regulation in the US.

Conclusions

The US Executive’s approach to crypto has shifted from dismissive to reactive

Regulators are embarrassed post FTX and clawing back credibility

Context required, no structural change in policy

Decentralised protocols are difficult to regulate

US crypto industry temporarily negatively impacted, pushing some innovation offshore

Reactive regulators are missing the wood for the trees, crypto is not going anywhere

Nigeria highlights the need for crypto adoption, no matter the legislation

US REGULATOR’S approach to crypto has shifted from dismissive to reactive

Prior to FTX, regulators in the Biden administration already had a less than desirable approach to crypto. Former SEC commissioner Hester Peirce noted in 2022 that the SEC under Gary Gensler’s leadership was somewhat dismissive of crypto and focused on one-off enforcement action. “What drove this initially was the feeling that crypto probably wouldn’t stay around… Why invest the resources in developing some kind of framework for something that's not going to stay?”

Source: New York Post

As an example of this unconstructive policy, there have been no exemptive orders under Gary Gensler’s leadership of the SEC (exemptive orders allow businesses to move forward and simultaneously allows regulators to achieve our regulatory objectives). I.E. The collaboration required guide the new industry and technology forward, merging old and new technologies for the benefit of consumers and businesses, has been lacking.

SEC clawing back credibility post FTX

As we noted at the time, the FTX debacle was one of the worst frauds since Enron. It is an embarrassment to US regulatory authorities that the FTX saga took place right under their watch (the SEC had unusually strong relations with FTX and Sam Bankman-Fried). As a result, US authorities are now reacting, escalating enforcement action against the industry. The negative enforcement action against Paxos by the NYDFS, against Kraken by the SEC and against Custodia Bank by the Fed news must be seen in this context.

Embarrassed US regulators are reacting to the FTX saga

Before we get too gloomy about this shift from dismissive to reactive policy-making, let us create a little context.

Not a structural change, merely an intensification of the existing policy

While there have always been crypto advocates in Washington, the Presidency has not been particularly supportive towards crypto under either the Trump or Biden Presidency. Remember, Trump’s Treasury Secretary Mnuchin tried to slip some very restrictive KYC policies under the radar in late 2020 ahead of the Presidential handover.

REGULATORS WANT TO ‘DO THEIR JOB’ - decentralised protocols untouched

Another year has passed and yet the worst fears of crypto critics remain unfounded. Mnuchin never got his restrictions through Congress, the US government has NOT banned bitcoin, ethereum or any other decentralised application. They also have not banned stablecoins nor handed out securities violations left right and centre. The way I see it regulation of decentralised financial applications is too difficult and thus regulators have merely taken their gaze to what they see as low hanging fruit. Large centralised businesses are in the public eye and will allow regulators to create the perception that they are "doing their job". The crypto industry has grown in leaps and bounds in spite on many unhelpful regulators. And, credit where it is due, some of the SEC's recent decisions have merit.

there are some justifiable reasons for ENFORCEMENT actions

Staking is NOT illegal in the US - the SEC just did not like Kraken’s product. Kraken centralised some management functions and offered reasonably stable returns to clients, which does arguably have some characteristics of a security.

Paxos is a stablecoin issuer that is regulated under the New York Department of Financial Services (NYDFS). There is no indication that there is anything wrong with Paxos' stablecoin or reserve-backed stablecoins (USDC, GUSD, etc) in general. Paxos has a partnership with Binance whereby Binance white-labels Paxos' stablecoin and calls it BUSD. This also appears to be a legitimate business operation.

Where the situation starts to get a little complicated is that Binance bridges BUSD onto multiple blockchains and it manages the locking of assets between the various chains. There is some evidence that BUSD has not been 100% reserve backed at times. Binance argues that this is merely an operational discrepancy, however the truth of the matter is that Paxos has no control over these bridges, which is where the NYDFS concern may lie.

The justification for these cases does not excuse the dismissive and reactive approach though. We are unlikely to get the type of thoughtful, collaborative and constructive regulation while the Biden administration remains in power, but who much worse could it get?

how much worse could be get?

Stablecoin regulation is critical and instructive

It is not our base case, but it is possible that the SEC's enforcement action against Paxos is the first step in a more concerted clampdown on stablecoins. Stablecoins are one of the key on ramps into crypto and they provide substantially inter-exchange liquidity. They are also a very useful medium of exchange and transfer for many crypto businesses that sit with USD denominated expenses or income. One could easily argue that stablecoins are one of the most valuable use cases for crypto outside of bitcoin so it would be foolhardy to ignore the impact of concerted negative regulation.

I have long been of the view that stablecoins will eventually be viewed positively by the US government because their adoption further entrenches the USD's position as the world's reserve currency. Regulated stablecoins are also an easy path towards a pseudo central bank digital currency (CBDC) whereby US authorities could readily gain personal information from stablecoin issuers. Given these compelling arguments to bring legitimate dollar stablecoins under the purview of US regulation and the Presidencies desire to pursue CBDCs, a decision to limit stablecoin adoption would suggest that authorities want to cut off their nose to spite their face and specifically hamstring crypto. I do not think we are quite at this point but what could regulators do if they want to tighten the screws on crypto?

Reserve backed stablecoins like the ones issued by Paxos, Circle and Gemini not securities so I do not think this is an option available to the SEC.

Perhaps authorities could choke off US stablecoins by limiting access to banking services. This seems unlikely because it would entail specific financial services discrimation against legitimate businesses, which is contrary to the stated objectives of regulators. These stablecoin issuers also do not hold decentralised crypto assets as collateral, which was likely the reason for denial of Custodia Bank’s application to become a member bank of the Federal Reserve. Plus, stablecoin issuers already have relationships with banking partners so it is a little more difficult for authorities to sever these existing relationship. Crazier things have certainly happened before so it is worth keeping this risk on the radar.

Even if authorities found a way to outlaw stablecoins, they would still exist outside of the US. Offshore unregulated issuers like tether would grow market share and new issuers would likely emerge. The incentive for stablecoin issuers to move outside of America would be reminiscent of the incentives behind the growth in FTX and provides a strong case against stringent regulation.

Widespread application of securities law POSSIBLE BUT challenging

Subsequent to the Kraken and Paxos news, SEC chairman Gensler has argued that all crypto assets other than bitcoin could be considered securities. We have warned about this is a possibility before. If this were to become legislation, it would likely have a remarkable impact on crypto markets because there is no doubt that many assets display some characteristics of securities. However, we should be cautious to draw that stark conclusion at this stage.

That Gary Gensler has circulated this opinion in the NY Mag implies that this is an opinion. He is trying to gather support for that opinion. If it were easy for Gensler to pass the relevant legislation, he would go ahead.

There are a number of members of Congress who stand in opposition to Gensler's opinion, including members of the Democratic Party (Gensler is a Democrat appointment under President Biden). As faulty as the US political system may be, Congressional members are elected by the American people to pass legislation. The SEC merely enforces that legislation. Gary Gensler is an unelected politician who was appointed to the role of SEC chairman and is not tasked with legislating powers. Gensler's opinion matters but not as much as Congress.

Senator Hickenlooper has said the “current lack of a coordinated regulatory framework leads uneven enforcement and hinders clear understanding of investor protection”. Senator Gottheimer, “Gensler has repeatedly claimed that most cryptocurrencies are covered by existing securities laws. Despite that, the SEC has not proposed a single rule to create guardrails for digital assets…They failed to do their job, and they failed to protect consumers.” Senator Ritchie Torres, “Mr. Gensler’s been in office for two years and he has not enacted a single rule that would bring greater transparency or accountability to the crypto sector…I’ve heard him express skepticism, but he’s not paid to be a commentator on crypto; he’s paid to be a regulator on crypto.”

Gensler’s SEC has shown a lack of appreciation of the underlying value of the technology and has failed to protect investors. If he attempts to push this type of thoughtless blanket legislation ahead, he will face strong opposition from those who are trying to utilise its use-cases. Large institutions from Blackrock, Deutsche Bank, and the California DMV are investigating the potential use-cases of this tech. All crypto use-cases are not necessarily securities. It seems peculiar that politicians in one of the most tech friendly economies in the world want to snuff out all of these possibilities.

Clear and thoughtful securities legislation of decentralised applications is very difficult. From this perspective, I have sympathy with regulators. For example, securities register with investment contracts which include disclosures regarding the key investment features. But a blockchain protocol's key features can and will change over time. For example, Ethereum's consensus protocol changed entirely in 2022. If ETH were declared a security, how does the SEC propose that the disclosures section of the SEC application is updated and who is responsible for updating it?

This argument does not imply that more restrictive application of securities law is not possible in crypto - it is. The SEC could easily ask all US crypto exchanges to provide a securities opinion on all listed tokens tomorrow. Banking authorities could also get a lot restrictive towards stablecoins. But I am still uncertain that these worst case scenarios would derail the industry. Any lasting crypto legislation would need to make its way through Congress where numerous crypto proponents lie. Plus getting legislation through a gridlocked Congress is difficult for even the shrewdest politicians.

Regulators are fighting an uphill battle

This regulatory shift is not the end of the world, I do not think it is going to result in outright war against the crypto industry, and this could all change as the US Presidential elections approach in 2025, but it is certainly undesirable and disappointing. While the SEC is trying to create the perception that they are doing their job, they are not actually protecting investors, consumers or businesses.

There are a plethora of examples which display the SEC’s inability to focus on its mandate, investor protection, including the failure to convert the Grayscale bitcoin trust into an ETF. Failure to do so has been a gross violation of investor protection because investors into the trust have experienced a 50% underperformance relative to spot bitcoin. More recently, the SEC blocked a deal that would see Voyager clients receive 73% recovery of funds. The bankruptcy judge was “absolutely shocked by the SEC objection”.

There are plenty of bad actors in the crypto space, Paxos and Kraken are almost certainly not them. It is reasonably easy for the SEC to target these companies and enforce the verdict because they are already regulated. Where the rubber really hits the road in terms of regulation is fraudsters like Sam Bankman-Fried who funded both Republicans and Democrats, the application of securities law on decentralised projects, the viability of privately issued stable coins and approval of standard financial instruments like ETFs. The SEC and US regulators need to wake up and create clarity on these topics.

Decentralised monetary and financial technologies have been invented, they are valuable and they are not going anywhere. These technologies will eventually disintermediate traditional financial participants, putting financial sovereignty back in the hands of consumers. Yet, the world’s largest economy and historically a very tech savvy country is temporarily turning away from constructive legislation on an industry that I expect will have a profoundly positive impact on humanity. I do not think we will see a mass exodus of crypto companies from the US but at the margin this will push crypto developers and entrepreneurs towards friendlier jurisdictions like Hong Kong, Singapore and Dubai.

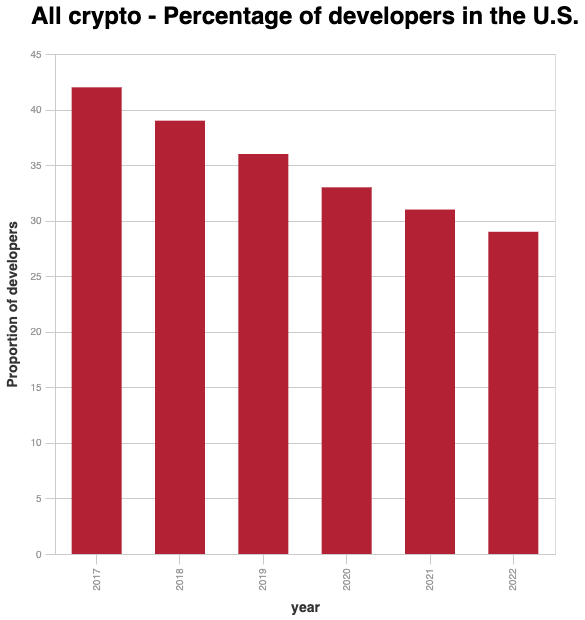

The US is already bleeding crypto developers

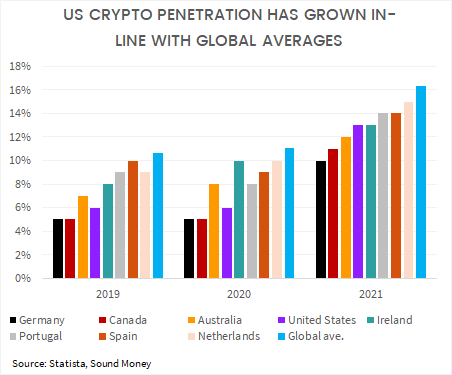

While US crypto penetration is moderate vs global peers, the US is estimated to have approximately 29% of all crypto developers within its borders, reflecting the outsized influence on the industry (data from Electric Capital). But proportion of global crypto developers in the US is down from 42% in 2018 so there has been a steady shift in activity away from the US. We should expect this trend to continue if US regulators remain on the current course. This does not imply a mass exodus of devevelopers and entrepreneurs but activity will filter towards friendlier jurisdictions. Bizarrely enough, this is contradictory towards the goals of US regulators who will reduce their global influence as they push their patrons to alternative jurisdictions.

The data also shows that crypto adoption in the US continues its upward trajectory in spite of reasonably unhelpful US regulators. Is it the case that the world needs decentralized financial technology and users will acquaint themselves with it, no mater the regulation? This argument is less conclusive in a place like America where CPI inflation remains in single digits and trust in the government remains moderately healthy. At the other end of the spectrum, Nigeria provides a perfect example where the value of decentralised financial products is self-evident, no matter the national regulations.

Nigerians adopt crypto because they need to, no matter the legislation

In late 2022 Nigerian government and central bank decided to remove a number of high value banknotes from circulation, which has resulted in distress, disorder and widespread protests in 2023.

The stated motivation for the government’s decision was an attempt to fight money laundering, black market activity, inflation, as well as a desire to move towards a cashless economy. In reality, Nigeria has been a poster-child for badly mismanaged centralised economic policy for many years. The US dollar has gained >400% vs. the Nigerian Naira since January 1999, which is the cause of rampant inflation. Not only is Nigerian monetary policy a mess, but there is limited trust in the financial system. In 2022 almost 85% of the 3.23 trillion naira ($7.18 billion) in cash in circulation had been held outside of banks. The failure the execute upon this banknote policy will further reduce the trust in centralised authorities.

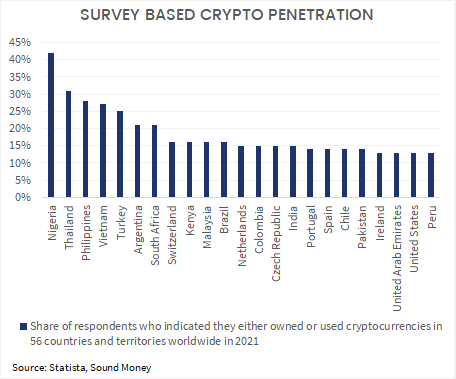

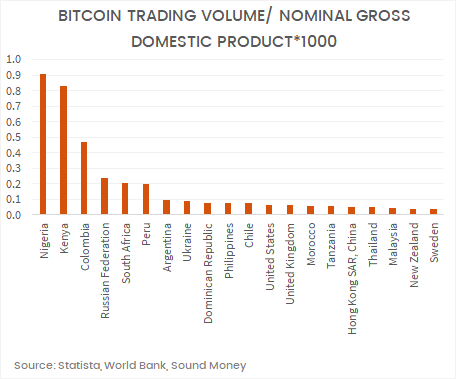

It is no surprise that bitcoin and crypto adoption is widespread in Nigeria, despite attempts to clamp down on the technology. In fact, on some metrics Nigeria has the highest level of adoption in the world. In a 56 country poll in 2021 Nigeria had the greatest share of respondents that indicated they had either owned or used cryptocurrencies. Nigeria also has the highest domestic currency trading volume/ GDP ratio in the world.

Clearly regulation and legislation matters and we must continue to monitor the potential impact. But I do not think starkly negative legislation should be expected in the world’s largest economy and I do not think there is much that legislators can do to stop the adoption trend of decentralised financial technologies. Nigeria is the poster child for economic mismanagement, but find me a country where the government isn’t corrupt, where the economy is not drowning in debt, where the central bank has not taken interest rates to the floor in recent years and where the politicians are still trying to spend their way out of the problems that they created. Every country is on the spectrum, including the historically sound democracies of the west.

Perhaps regulators can alter the slope of the line through craft legislation, but adoption will trend up and to the right because the authorities who control centralised financial technology continue to abuse interest rates, debt and public spending. Freedom will eventually prevail.