Market Review: Relief OFF lows, monitoring exuberance

Good news, the Price family is celebrating a new arrival, the blossoms are out in Santa Monica, and bitcoin has experienced its strongest month since February 2021. The 2023 outlook is clearly more optimistic than 2022, but this is not a signal that the challenges are entirely behind us. We need corroborating evidence to dollar weakness to confirm a new macro cycle in 2023. Market exuberance would be a sign that we have got ahead of ourselves.

Highlights:

Bitcoin rallied 39.1% in January 2023, its biggest monthly rally since February 2021

We expect November 2022 marked the cycle lows

USD weakness has been a key factor driving improvement in macro conditions

Corroborating evidence of macro upswing required from money supply

Dollar strength will present challenges again 2023

Perpetual funding rates suggest exuberance is already emerging

Right on queue bitcoin rallied 39.1% in January 2023, its biggest monthly rally since February 2021. As we noted last month, there are a number of factors supporting strength in 2023:

A new cyclical low on BTC would mark the longest bear market in its history so it is timeous if we marked the cycle low in November 2022.

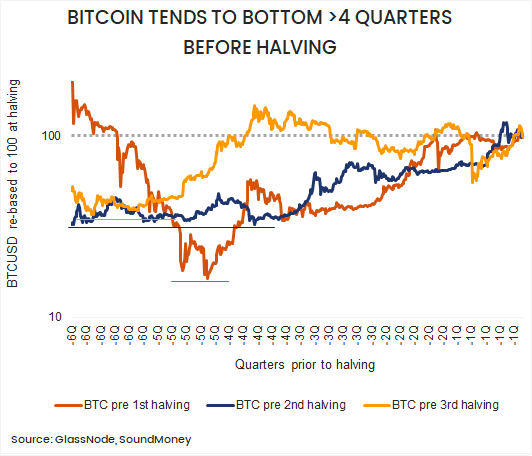

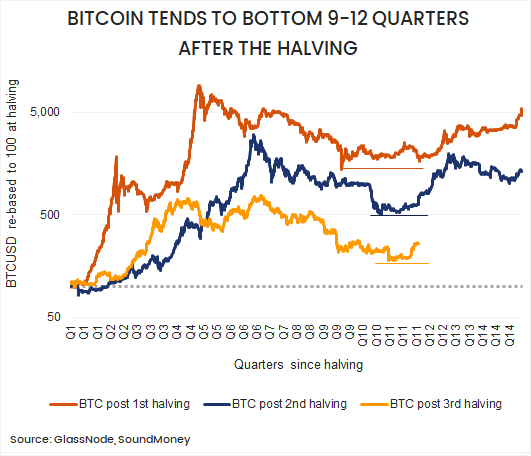

BTC tends to bottom 9-12 quarters after the previous halving and more than 4 quarters before the next halving. We are currently 10 quarters from the last halving in May 2020 and 5 quarters before the next halving in May 2024, suggesting that we are in the period where bitcoin would be expected to bottom.

2022 was marked by substantial capitulation with the FTX debacle as the crescendo, yet price was increasingly less reactive.

Markets do not always require a catalyst but if you are looking for one, look no further than the Fed and inflation. CPI y/y has dropped to 6.4% in Jan from a high of 9% in June 2022. This is the lowest reading since October 2021 but still a long way above the Fed's 2% target. Softer inflation and the monetary space it provides to Fed policy is the narrative driving risk asset prices higher in January.

Below the surface, USD weakness since October 2022 is a key factor, loosening global liquidity and elevating risk appetite. Despite the weakening in the dollar and improvement in macro conditions, we have not yet received broad-based confirmation of a shift in macro regime. This remains an important factor to consider over the coming months. Failure to witness an uptick in money supply growth could easily dampen risk appetite again.

While we are obviously more constructive on the crypto outlook in 2023, we remain cautious about the potential for a stronger dollar to restrict risk appetite. We had pinpointed the 101 area on the DXY as an area of potential reversal and will watch the reaction closely in the coming weeks.

Source: Trading View

Bitcoin dominance has risen steadily from 4the start of December, which is a sign of a much more healthy crypto market dynamic. We expect dominance to rise further in 2023 and think it will remain difficult for broader based outperformance vs. BTC for any extended length of time.

Nevertheless, there is a reasonable prospect for ETH outperformance in Q1. We expect that risk appetite may ratchet up another notch, following the relief experienced in Jan 2023, supporting ETH and other riskier crypto assets. This could, however, see a somewhat frenzied dynamic emerge as participants speculate about the prospect of extended 2021-style bull-market to emerge in 2023. We do not expect the froth of 2021 to re-emerge in 2023 for an extended period of time. Rising funding rates on leveraged derivative contracts have risen to the highest levels since late 2021 which suggests that speculators may starting to get a little ahead of themselves already.

We plan take profits into frenzied conditions because macro conditions still need to recover further and crypto developers need more time to generate the types of useful applications that will fuel the next bull market.

Bitcoin is currently tracking the 1st year average of past bull-markets. There are numerous paths forward from here:

In 2011 BTC rallied almost 200% in the first quarter after its cycle lows, which led to a 40% decline in the 2nd quarter.

In 2018 BTC saw an extended 300% rally through the 1st and 2nd quarter post its cycle lows, which led to an almost 50% decline in the 3rd quarter

In 2015 BTC only managed to rally 50% by the end of the 2nd quarter and gave up those gains in the 3rd quarter.

We expect this cycle will be unique but these past experiences tell us that sharp rallies and declines are expected in the first year of a potential bull-market. So while we have clearly argued for a more optimistic outlook for 2023 than 2022, caution is still advised and active management should be able to outperform the market.

Those who are not actively managing their portfolio should avoid getting too caught up in the weeds. Evidence suggests that these remain wonderful long-term allocation opportunities. The risk is that “this time is different” and bitcoin marks a new cycle low in 2023. We think that this is a low probability event but not impossible. Tough macro conditions and tight liquidity will almost certainly generate further market weakness in 2023. The question is, how much pain will we experience in price? We expect equity markets could easily revisit their lows and that this will put a fair amount of pressure on crypto again. So it is wise not to chase price at these prices, particularly not with a short-term time horizon. It would be advantageous to have some dry powder on hand, if this scenario of weaker equity markets materialises. But we expect that BTC and ETH will hold up relatively well and won’t revisit the cyclical lows. We expect that the forced selling through 2022 and the shift in holdings from weak to strong hands has created a new price base for another exuberant bull-market in 2024 and 2025.